Nowadays, the financial services industry is changing. It’s estimated that 68 trillion dollars in wealth are being transferred from baby boomers to millennials. To meet millennials’ high expectations, providers need to enhance the speed, convenience, and technological sophistication of financial services. More than half of people born between 1981 and 1996 declare that they would switch over to the competition if it offers a better technological experience. Such trends cause the rapid development of Fintech (financial technology) in banking, digital payments, financial management, and insurance.

Google Maps Platform solutions for financial services

Google decided to help meet the growing expectations of the customers and launched a set of solutions for financial services. They are designed to improve the security, user experience, and your company’s operations. Google prepared technical guidance and special APIs that you can use to build three financial service solutions:

- Enriched Transactions

- Quick and Verified Sign-up

- Branch and ATM Locator Plus

Additionally, Google shared two examples of using APIs for finance: Contextual Experiences and Fraud Detection.

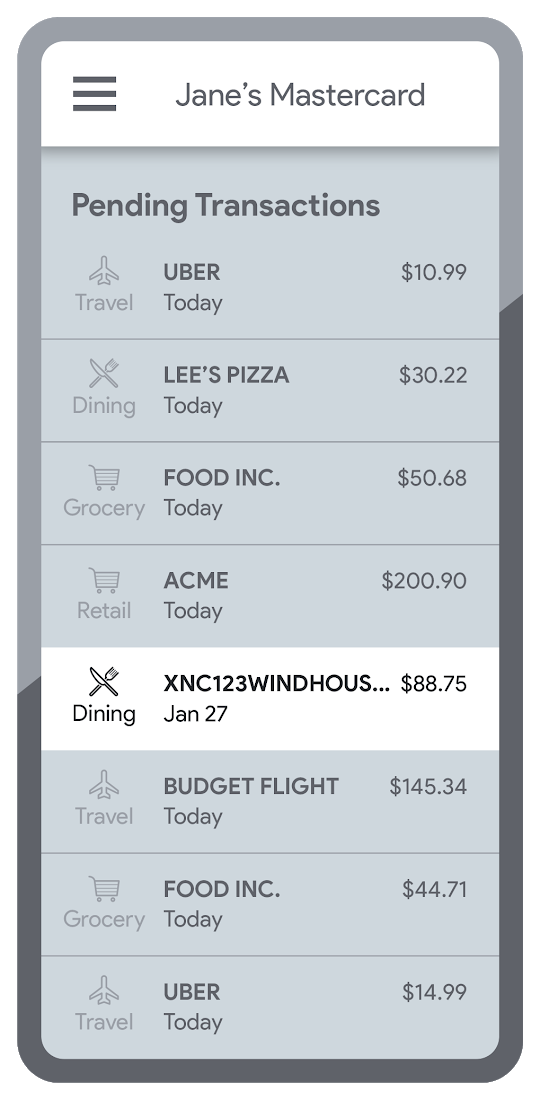

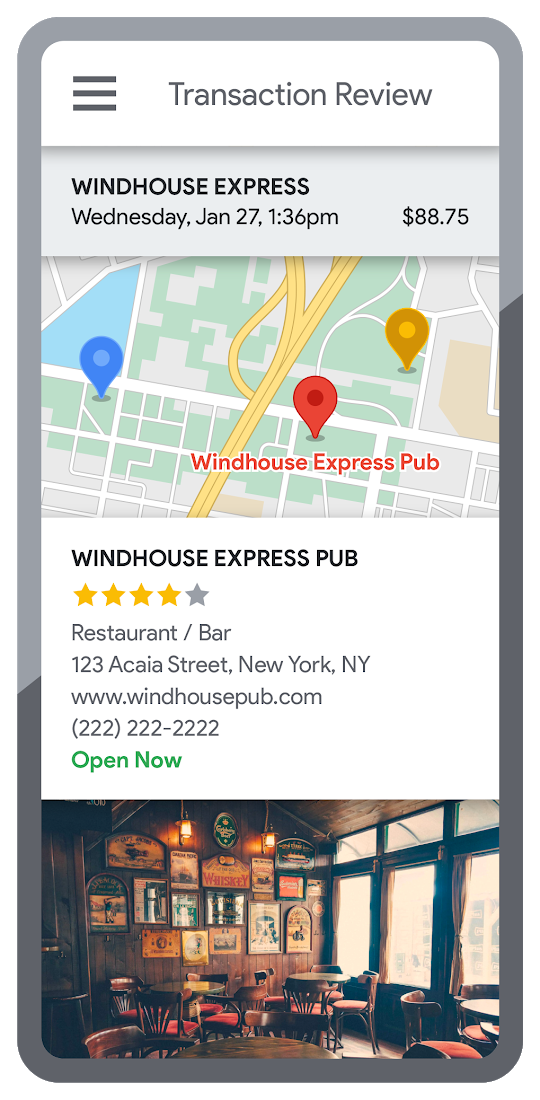

The Enriched Transactions solution: clarify financial statements

Customers often struggle to recognize information in their transaction history. The abbreviations used in such statements, such as “ACMEHCORP” aren’t straightforward like the regular name, e.g. “Acme Houseware”. Enriched Transactions adds vendor name, business category, storefront photo, location on a map, and full contact information. This solution makes it easy to identify transactions and that increases customer trust. Companies using Enriched Transactions have observed a 15% increase in their Net Promoter Scores which assesses customer loyalty. Additionally, the number of time-consuming and costly support calls has dropped by 67% on average.

You can also let your customers easily visualize their transactions on Google Maps including the vendor name, as well as transaction amount and date. This gives the users valuable insights into their spending habits.

We encourage you to check out Google’s implementation guide for Enriched Transactions.

Before: Traditional transaction summary

After: Enriched Transactions view

The Quick and Verified Sign-up solution: faster registration for your customers

Manual address entry often leads to incorrect data and costly delivery mistakes, as well as lower conversion rates. Quick and Verified Sign-up speeds up and simplifies the process by suggesting address names after the customer entered just a few first letters. This solution shortens registration time up to 64% and increases conversion rates by up to 15%.

Quick and Verified Sign-up also brings an additional level of address verification that lowers the risk of fraudulent account sign-ups. Companies that use geospatial data to verify customer identities report approximately 30% fewer fraudulent accounts setups.

See the Quick and Verified Sign-up solution guide from Google.

The Brand and ATM Locator Plus solution: makes it easier for your customers to visit your physical locations

74% of customers research information about a given place before they go there so it’s essential to provide them with detailed profiles of each location. Branch and ATM Locator Plus improves your websites and applications by sharing the same information about your offices and ATMs that appear on Google Maps. Make sure that your customers can easily find opening hours, services you offer, user ratings, photos, directions, and other useful information about your business.

The financial service providers that share detailed information about their branches and ATMs report 14% higher NPS and 7% fewer support calls.

See the Google guide for Branch and ATM Locator Plus implementation or easily create this solution with Quick Builder.

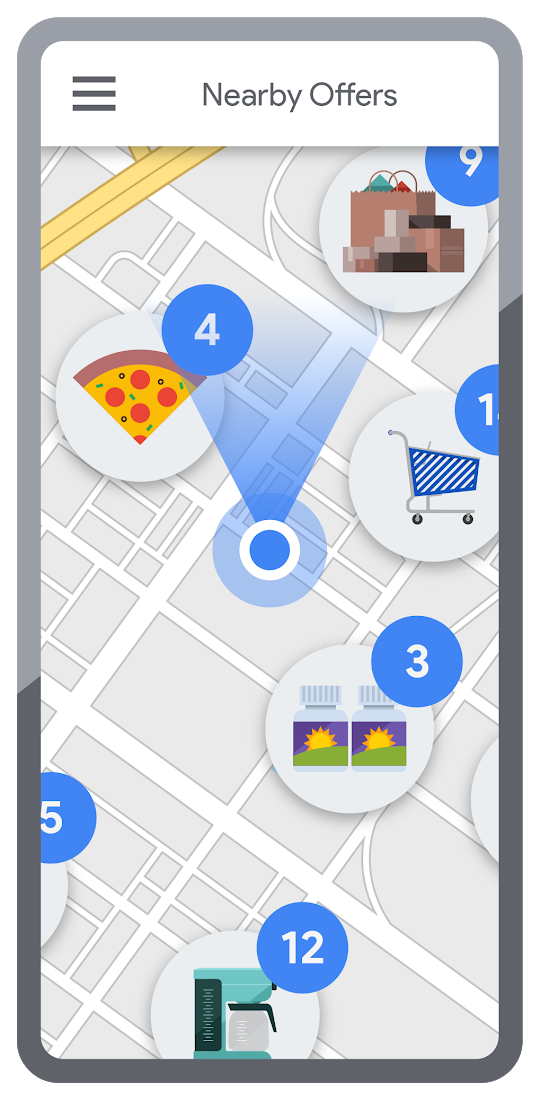

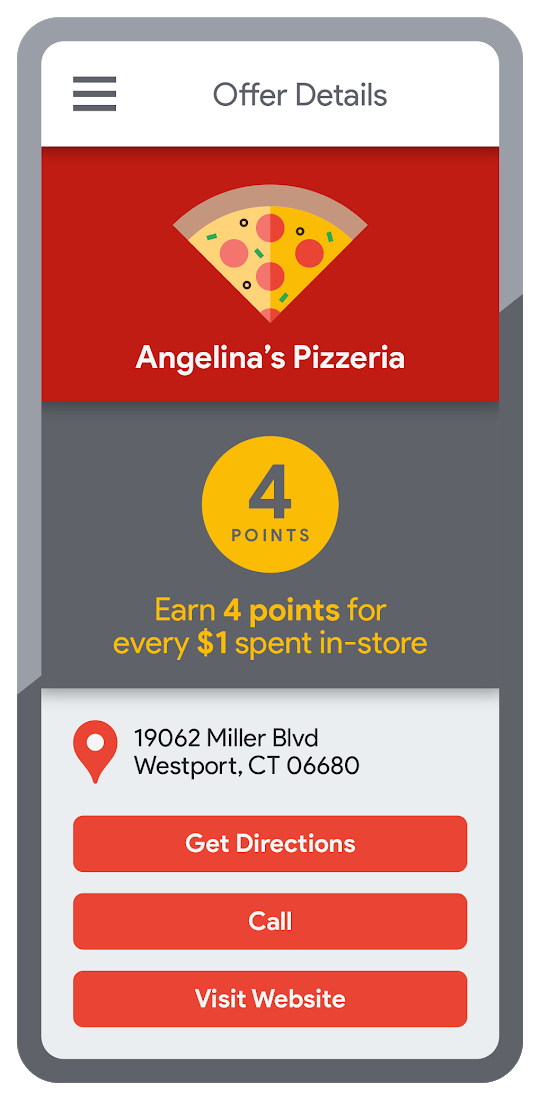

The Contextual Experiences solution: increase customer satisfaction with special offers and rewards

Special deals, rewards, and cash-back programs can all be powered by real-time, geo-targeted offers and visualized on Google Maps. Using insights from transaction histories, customer consent for location-based features, and the Contextual Experiences solution, you can offer personalized deals and reward programs. This increases customer engagement.

The benefits for both financial service providers and their customers are confirmed by an 8% increase of NPS and an 8% extension of time spent by users in apps.

Present nearby offers on the map

Connect the user to the offer that interested them

The Fraud Detection solution: detect suspicious transactions

Fraud Detection allows you to use the customer mobile device location shared with the customer consent to detect suspicious activity based on geographic distance. An example could be an ATM withdrawal that happened at a large distance away from a customer’s smartphone. Google APIs can also identify series of suspicious transactions, such as a purchase completed at a physical store far away from a previous transaction.

Companies from the finance industry that use geospatial data to verify their customer identities report about 70% fewer fraudulent transactions and a reduction of false positives in fraud detection by approximately 45%.